873

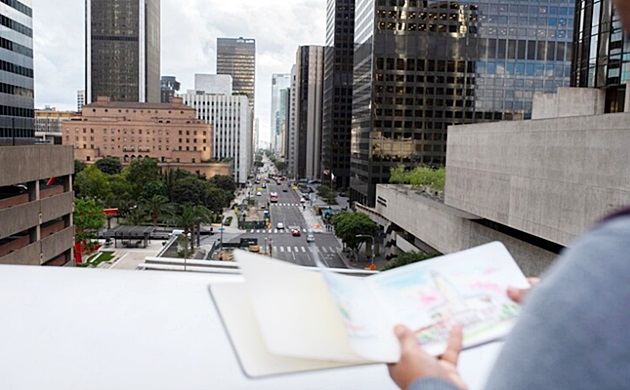

The areas around cities with a variety of restaurants, cafes, shops, and offices have long been locations for companies seeking to attract top talent. But the benefits have taken on new meaning amid efforts to encourage employees to return to the office, according to a JLL study.

The value of working in an office

"Companies recognize the value of high-quality offices and prime locations, not only for recruitment and retention advantages but also to motivate return-to-office strategies," says Jacob Rowden, director of U.S. office research at JLL. "And increasingly, these places are appearing in the peripheral regions of the urban core."

Indeed, in the U.S., primary office corridors are migrating away from central business districts (CBDs), according to JLL research. Peripheral urban neighborhoods are becoming increasingly dominant, now representing 54% of the most expensive streets in the U.S.

The report found that while Sand Hill Road in California and Hudson Yards in New York still command the highest office rents, interest in mixed-use environments is growing as consumer habits evolve.

Activity levels in areas with a more diverse distribution of property types between commercial, residential, and entertainment uses have rebounded faster than commercially dominated cores.

Europe is faring better

In Europe, there's a broader effort to provide neighborhoods and entire places that keep people engaged beyond the workday. In the UK, the £500 million ($634 million) revamp of Birmingham's Smithfield district will create public and commercial space alongside 2,000 new homes. Essentially, a new street network will be implemented over what was once a major wholesale market.

European cities have been moving toward tighter integrated development since the signing of the Leipzig Charter by the European Union in 2007, aiming to avoid cities segregating functions into districts.

The presence of multiple self-sufficient sub-markets, as found in Berlin, can help insulate against job vacancies. While Europe's job vacancy rate was 8.1% in the first quarter, Berlin's rate was only 5.4%.

"The pandemic has shown that a siloed approach to planning around commercial real estate can see disadvantages at different points in the cycle," says Rowden. "More than ever, cities and developers are now seeking to create symbiotic ecosystems of vibrant real estate that deliver benefits across multiple uses." (Photo: Freepik)