1283

According to MarketsAndMarkets, which recently published the report "Technical Insulation Market by Material Type (Hot, Cold Flexible, Cold Rigid), Application (Heating & Plumbing, HVAC, Refrigeration, Industrial Process, Acoustic), End-Use (Industrial & OEM, Energy, Transportation), and Region - Global Forecast to 2028", it is estimated that the technical insulation market will grow from 10.3 billion USD in 2023 to 13.4 billion USD by 2028, at a CAGR of 5.3% during the forecast period.

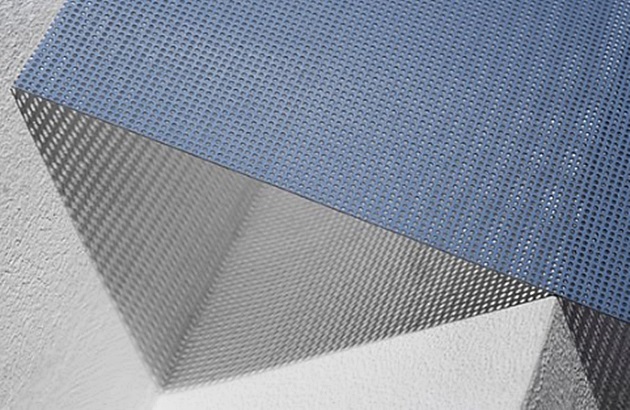

Technical insulation has gained widespread acceptance in various industries, including industrial and OEM, energy, transportation, and commercial buildings. The industry is poised for growth due to strict regulations governing equipment and pipe insulation, along with increasing demand in the oil and gas sector.

These factors are expected to drive the expansion of related industries, thereby contributing to the overall growth of the technical insulation market.

Some of the prominent key players are:

Rockwool International A/S (Denmark)

Saint-Gobain ISOVER (France)

Owens Corning (USA)

Kingspan Group Plc (Ireland)

Armacell International S.A. (Luxembourg)

Morgan Advanced Materials plc (UK)

Knauf Insulation (USA)

It is estimated that the hot insulation segment dominates the overall technical insulation market.

The hot insulation or artificial mineral fibers category includes rock wool, glass fiber, cellular glass, calcium silicate, microporous insulation, aerogel, and vacuum insulated panels.

It is anticipated to demonstrate the highest Compound Annual Growth Rate (CAGR) in terms of value from 2023 to 2028.

This growth can be attributed to the efficient thermal insulation properties of artificial mineral fibers, contributing to energy consumption reduction, heat surface protection, and stabilization of temperature fluctuations in both buildings and workplaces.

Furthermore, these materials provide acoustic insulation, reducing noise in the workplace and preventing issues such as hearing loss and noise pollution. Additionally, they exhibit minimal moisture absorption, low leaching, and long-term insulation performance.

Industrial processes with the largest market share of technical insulation by applications

Insulation materials play a crucial role in various industrial applications, including insulated piping, equipment and tanks, as well as instrument tubing installation, steam tracing, and pre-insulated pipes.

These applications are predominant in industries such as refining, petrochemicals, power and energy, marine, and pulp and paper.

The main objectives of using insulation in industrial processes are managing surface temperatures for personnel safety, regulating and stabilizing process temperatures, preventing condensation and potential corrosion on cold surfaces, improving fire protection, and controlling noise and vibrations.

Industrial & OEM is the largest end-use market for technical insulation

Well-insulated industrial facilities are essential for minimizing energy consumption and ensuring equipment durability. In industrial settings, high compressive strength insulation is used to maintain thickness during and after installation.

Technical insulation materials must have low thermal conductivity, low water absorption, effective noise reduction, and corrosion resistance. These properties are crucial for technical insulation, making the industrial sector the fastest-growing end-use industry from 2023 to 2028.

The demand for insulation materials is driven by industrial commitment to energy efficiency and sustainability. The emphasis on maintaining nominal thickness after installation is vital for sustained effectiveness.

Low thermal conductivity regulates temperatures, while minimal water absorption prevents moisture-related issues. Effective noise reduction enhances the working environment, adhering to safety standards.

Additionally, corrosion resistance protects equipment, contributing to overall durability. Integrating these properties underscores the essential role of insulation in enhancing industrial efficiency and sustainability.

Asia Pacific will be the largest technical insulation market

The technical insulation market in the Asia Pacific region is projected to record the highest CAGR between 2023 and 2028. The Asia Pacific technical insulation market is segmented into key countries, including China, India, South Korea, Japan, Australia, and the rest of the Asia Pacific.

This region emerges as a profitable market for technical insulation, driven by industrial development and improving economic conditions. With approximately 61% of the world's population, the Asia Pacific region is a significant contributor to the growth of manufacturing, industrial, and processing sectors.

The significance of the market lies in the increasing demand for technical insulation in these sectors. As economies advance, the need for insulation materials for temperature control, energy efficiency, and safety purposes is growing.

Overall, the Asia Pacific region plays a crucial role in the global technical insulation market, with its large population and growing industrial landscape, making it a key market for industry expansion. (Photo: Freepik)